What is a cryptocurrency and fiat money and what is different between them?

|

| What is a cryptocurrency and fiat money and what is different between them |

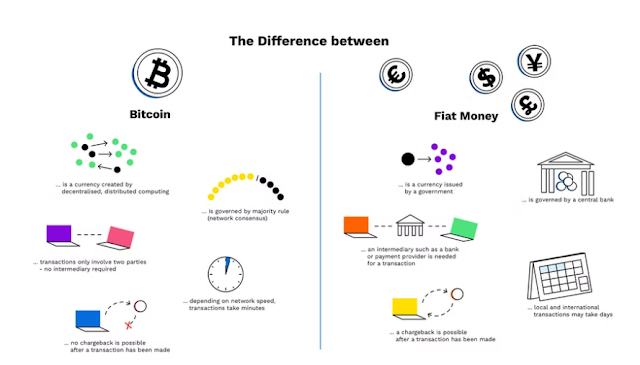

Cryptocurrencies are similar to traditional fiat currencies in many ways, but they can also have interesting benefits.

Both can be used for payment and value storage

Both rely on general consumer trust to act as an exchange mechanism

Fiat currencies are issued and controlled by banks (central banks) and governments

Bitcoin is created and distributed through the process of mining and is not controlled by a central government

Bitcoin can be trusted because it cannot be corrupted and cannot be used twice.

Bitcoin transactions cannot be exchanged, canceled, or redeemed.

In this course, you will learn the difference between cryptocurrency and fiat money.

Equities and traditional currencies have two important properties: they allow two parties to make uncontested payments and act as a store of value.

While the reliability of fiat currency is ensured by money issued by the central government, the reliability of cryptocurrencies depends on the underlying technology - blockchain technology.

When you buy something with a fiat currency, you have to rely on a trusted government such as the European Central Bank (ECB) or a government agency as an intermediary that guarantees the value of the currency.

In both cases, the buyer and seller have confidence that the currency will retain its value after the transaction.

What is fiat money?

Commercial income is derived from its value, such as precious metals (such as gold and silver), salt, or even slate. Fiat currency has value because the government declares it to be legal tender - it has no intrinsic value.

What is digital currency?

Cryptocurrencies are digital assets that act as a medium of exchange between two parties. They allow direct transactions between individuals without intermediaries such as banks. Although inflation affects fiat currencies and central banks always print more, Bitcoin, the largest cryptocurrency, has a fixed supply of 21,000,000, making it even more abundant than gold.

Are cryptocurrencies and fiat money the same?

Cryptocurrencies are currencies because they enable exchange between two parties and act as a store of value. But they also offer features that the traditional financial system cannot currently offer: anyone can issue and receive digital currencies worldwide, at any time, and through any bank or government. This is the most revolutionary aspect of cryptocurrencies.

Moreover, fiat money is synonymous with debt. When the central bank issues bonds, it gives you, the consumer, a percentage of the national debt as a one-time payment. Can you ask him logic how it is? Consider, for example, the EU-US economy.

Fiat currency has value because the government declares it to be legal tender - it has no intrinsic value.

Most of the money the government makes comes from borrowing money. Banks create money when people borrow money. Consider the case of the US dollar: if they don’t invest, they won’t have any dollars going. In other words, if consumers did not borrow money from banks, they would not exist in the world.

While fiat currencies seem to derive most of their value from debt, this is not the case with Bitcoin. Bitcoin has an inherent value that goes beyond the trust of its community. Bitcoin does not rely on a debt system, its value comes from how well it functions as a medium of exchange.

Cryptocurrencies can be issued by anyone, anywhere, at any time, without the help of banks or governments. That’s what makes them so revolutionary.

Bitcoin has created a new form of trust for our future global financial system. The system behind Bitcoin is completely transparent and based on the mathematics and consensus of the everyday user. With all of this in mind, what does the future hold? Bitcoin or fiat?

WARNING

This article is not investment advice, nor is it an order or solicitation to purchase a crypto asset.

This article is for informational purposes only and no warranty, accuracy, completeness, or truthfulness is given regarding this article or the opinion expressed herein and should not be relied upon.

Certain statements in this article may be forward-looking statements based on our current expectations and assumptions and may not be predictable.

Social Plugin